Platform Report 2022

Platforms and Zombies!

Integrated, flexible, accurate risk profiling at no cost

40+

Pages

27

Chapters

22+

Platforms Rated

Method in the madness

This guide provides analysis of the financial performance of the major advised platforms over the last three years. The platforms covered in this report together account for more than 90% of the total AUA (Assets Under Administration) in the adviser market. We examine key metrics to give a clearer picture of the financial health of platforms: AUA, revenue, pre-tax profits/ losses, yield on assets and profit and loss (P&L) account reserves over the last three years.

What's the focus?

The report focuses on the financial performance of the platform businesses, not their parents. We’ve trawled through numerous annual accounts and hundreds of data points to get a good picture of the financial health of the platform sector. And yes, the infamous FinalytiQ Financial Performance Rating is back! We’ve rated the platforms, and provided a summary of the financial health of each business.

Rewatch Our Webinar

On Wednesday 14th December 1:00 – 2:00 pm, we hosted our annual platform webinar. In which we discussed the core points of the report.

Want to a copy?

Market Overview

Assets on advised platforms grew by over 15% from £618bn to £717bn in 2021, the second fastest rate in the past five years. Collectively, platforms turned a profit of £200m (2020: £190m) on their revenue of £1714m (2020: £1550m) , a pretax margin of just over 11%.

This year, the music stopped...

Parmenion was rumoured to be looking for a new buyer, at a whooping £400m valuation, four times what the PE firm Preservation Capital paid for it only 18 months ago. Caledonia was also reported to be looking to offload 7IM, again at a valuation of £400m, a few months after it rejected a £300m bid from Brooks Macdonald.

Platform Report 2022

Platforms and Zombies!

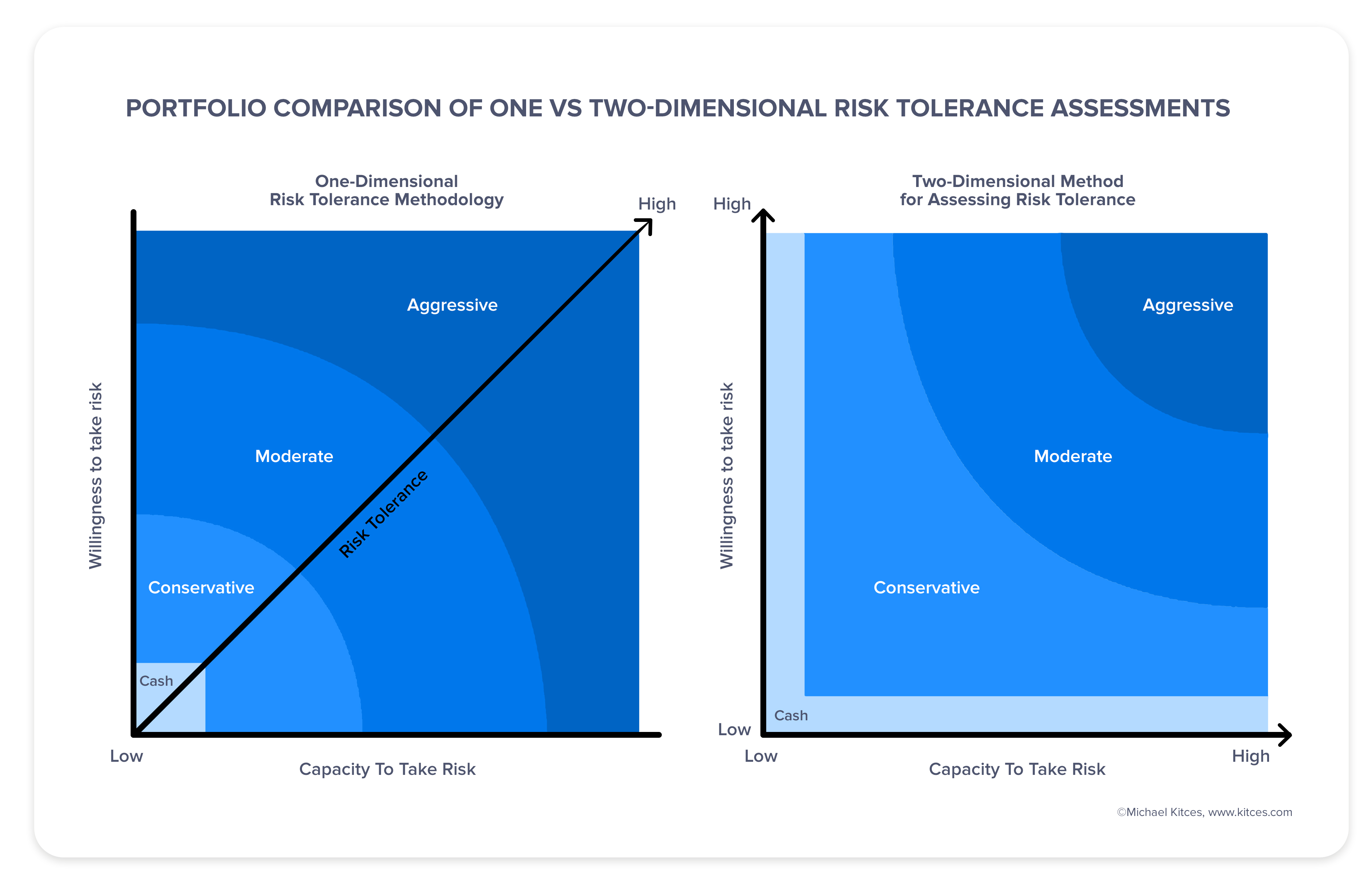

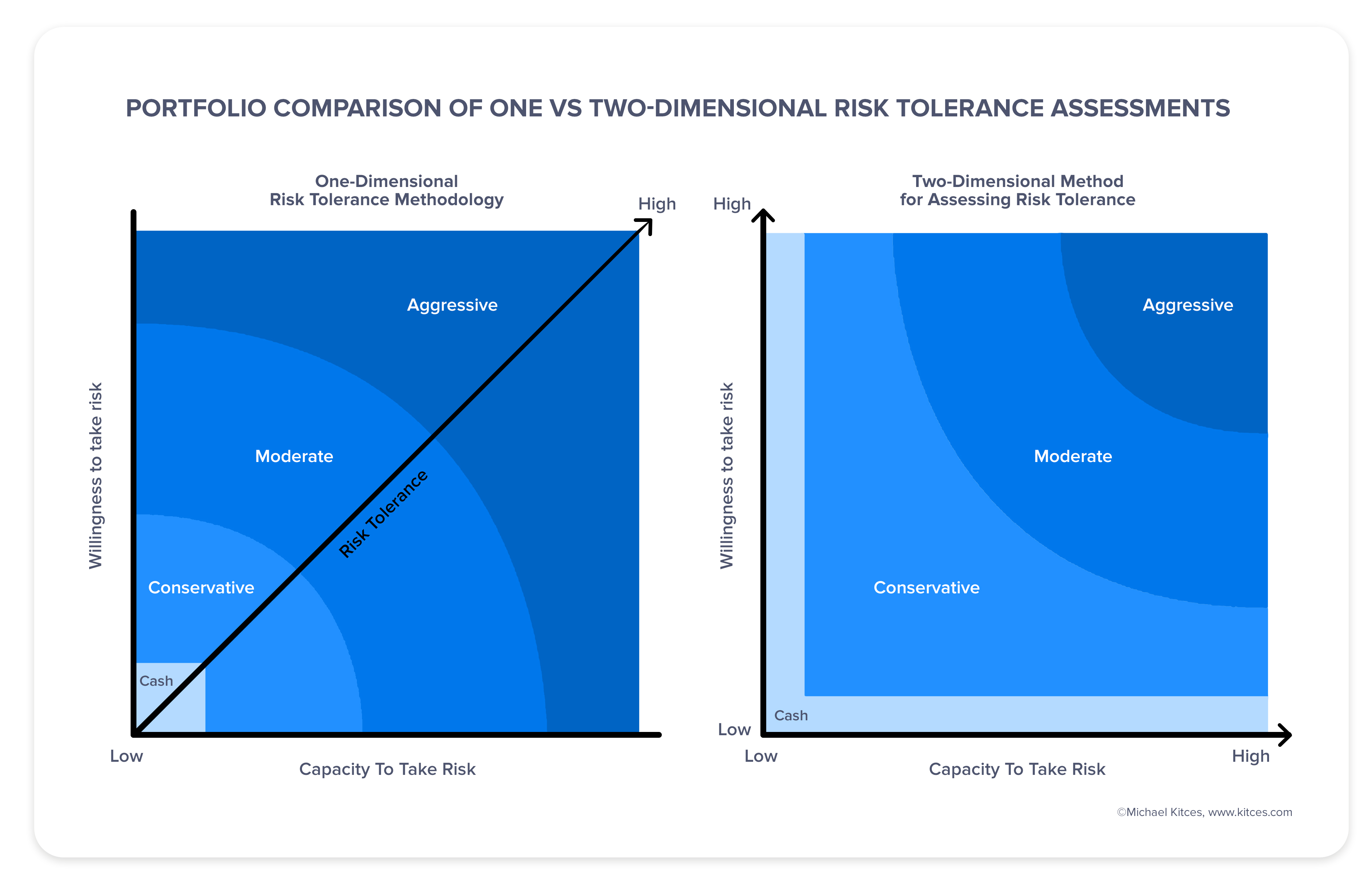

Calculating capacity for loss properly

Risk profilers typically tend to try to measure Capacity for Loss by asking questions about the stability of your income sources, but those in supposedly 'stable' jobs can one day be made redundant unexpectedly, while many self-employed people might have stable income for years.

Timeline's Risk Profiling integrates with Timeline's Financial Planner, and calculates a client's capacity for Loss based on an analysis of how their financial plan would fare across hundreds of scenarios from 120 years of history.

Calculating capacity for loss properly

Risk profilers typically tend to try to measure Capacity for Loss by asking questions about the stability of your income sources, but those in supposedly 'stable' jobs can one day be made redundant unexpectedly, while many self-employed people might have stable income for years.

Timeline's Risk Profiling integrates with Timeline's Financial Planner, and calculates a client's capacity for Loss based on an analysis of how their financial plan would fare across hundreds of scenarios from 120 years of history.

Matching a client's score to the right portfolio

©2022 Timeline Holdings Ltd. All rights reserved. Privacy Policy

Timeline Planning is a product of Timelineapp Tech Limited. Registered in England. RC: 11405676. 1 Tower House, Hoddesdon, Herts, EN11 8UR

Timeline Portfolios Ltd is incorporated under the laws of England and Wales (Company number 11557205) and is authorised and regulated by the Financial Conduct Authority (number 840807).

Past performance is no guarantee of future return. The value of investments and the income from them can go down as well as up. You may get back less than you invest. Transaction costs, taxes and inflation reduce investment returns.