The Multi-Asset Fund Report 2022

DON’T TAKE ANY

WOODEN NICKELS

The Multi-Asset Fund Report 2022. Watch the webinar recap and download the paper.

Integrated, flexible, accurate risk profiling at no cost

22+

Pages

8

Chapters

INTRODUCTION

With the soaring popularity of mutual funds, every fund manager touts their funds as superior and high-ranking, which is not surprising. But whether they are real gems or merely a thin veneer of gold with wooden nickel underneath, needs careful consideration. Like the previous years, we have evaluated the best performers for this year too. The Usual Suspects are topping the chart, with some newcomers joining them.

Following a dramatic couple of years through the pandemic 2020 and, 2021, 2022 was seen as the year of transition towards normalcy. But what followed in 2022 was memorable. One for case studies in the years to come.

METHODOLOGY

Our assessment process is fundamentally based on long-term performance rather than short-term. We follow a structured rating process that involves both quantitative and qualitative factors. The assessment process is comprehensive and includes a benchmarking exercise.

View the webinar recap

On Wednesday 8th February, we hosted our multi-asset webinar, in which we discussed the core points of the report.

Ready to download?

SELECTION OF A FUND UNIVERSE

An effective fund selection methodology is important to ensure the outcome is comprehensive and efficient. The varying level of volatility among funds could prove difficult when using them for comparison.

So, we have used funds within FE Analytics’ Risk Targeted Multi-Asset (RTMA) universe, which clubs funds into risk categories based on their historical risk score, a measure of volatility relative to the FTSE 100 index.

ASSESSMENT & RATING CRITERIA

The funds are rated in an unbiased method based on the outcome of the overall score derived from the analysis. This year’s ranking criteria reflect factors that are key to high quality returns and the psychological process of investing over the long term and maintaining a level-headed approach to investing.

Our assessment criteria encompass the critical factors of cost, performance, and risk. The returns should also be in relation to the risk taken, so we target risk-adjusted returns over time with costs.

The Multi-Asset Fund Report 2022

DON’T TAKE ANY

WOODEN NICKELS

The Multi-Asset Fund Report 2022. Watch the webinar recap and download the paper.

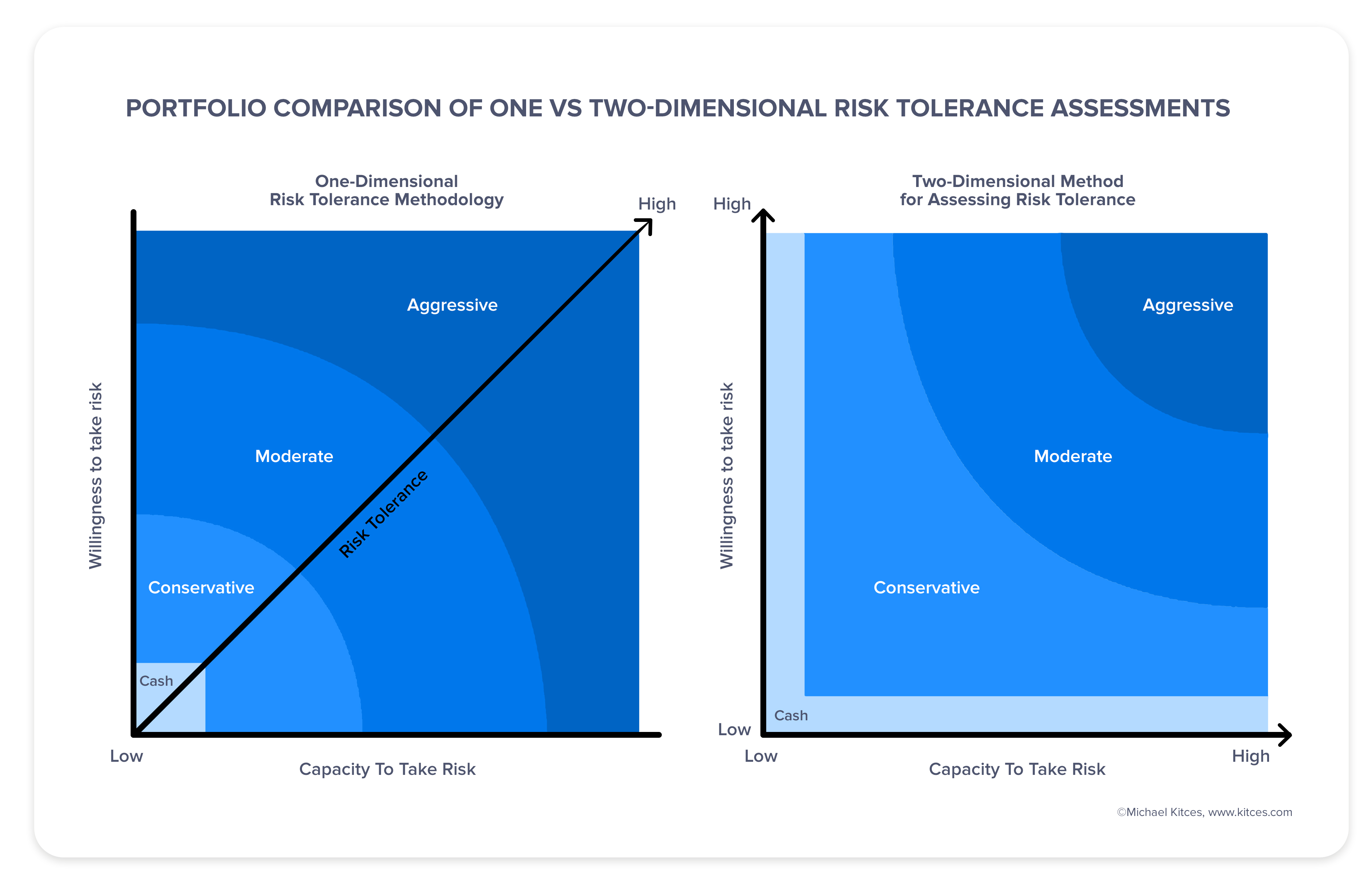

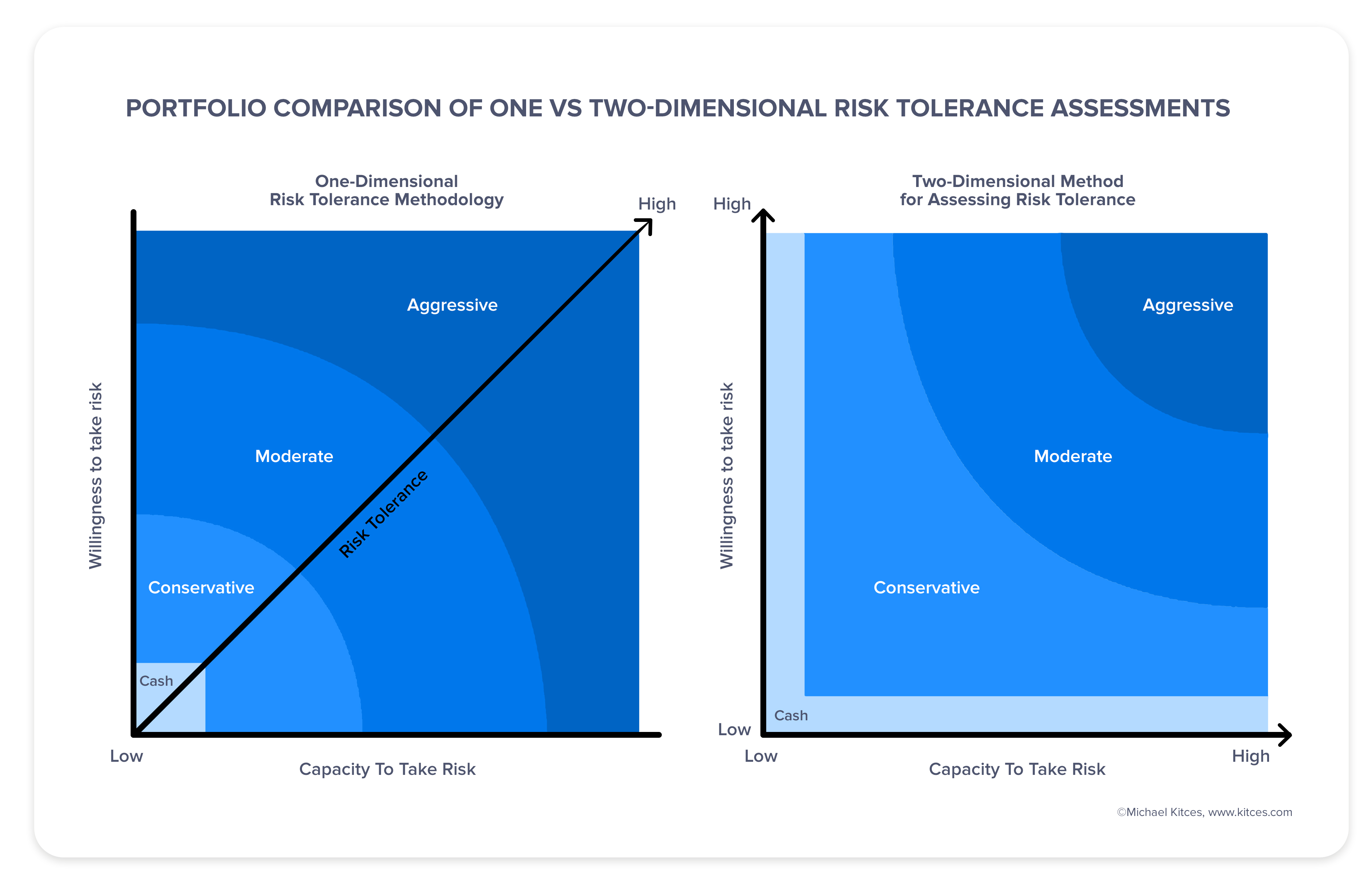

Calculating capacity for loss properly

Risk profilers typically tend to try to measure Capacity for Loss by asking questions about the stability of your income sources, but those in supposedly 'stable' jobs can one day be made redundant unexpectedly, while many self-employed people might have stable income for years.

Timeline's Risk Profiling integrates with Timeline's Financial Planner, and calculates a client's capacity for Loss based on an analysis of how their financial plan would fare across hundreds of scenarios from 120 years of history.

Calculating capacity for loss properly

Risk profilers typically tend to try to measure Capacity for Loss by asking questions about the stability of your income sources, but those in supposedly 'stable' jobs can one day be made redundant unexpectedly, while many self-employed people might have stable income for years.

Timeline's Risk Profiling integrates with Timeline's Financial Planner, and calculates a client's capacity for Loss based on an analysis of how their financial plan would fare across hundreds of scenarios from 120 years of history.

Matching a client's score to the right portfolio

©2023 Timeline Holdings Ltd. All rights reserved. Privacy Policy

Timeline Planning is a product of Timelineapp Tech Limited. Registered in England. RC: 11405676. 1 Tower House, Hoddesdon, Herts, EN11 8UR

Timeline Portfolios Ltd is incorporated under the laws of England and Wales (Company number 11557205) and is authorised and regulated by the Financial Conduct Authority (number 840807).

Past performance is no guarantee of future return. The value of investments and the income from them can go down as well as up. You may get back less than you invest. Transaction costs, taxes and inflation reduce investment returns.